Let’s talk about Blu-ray release activity on a

year-to-date basis this week.

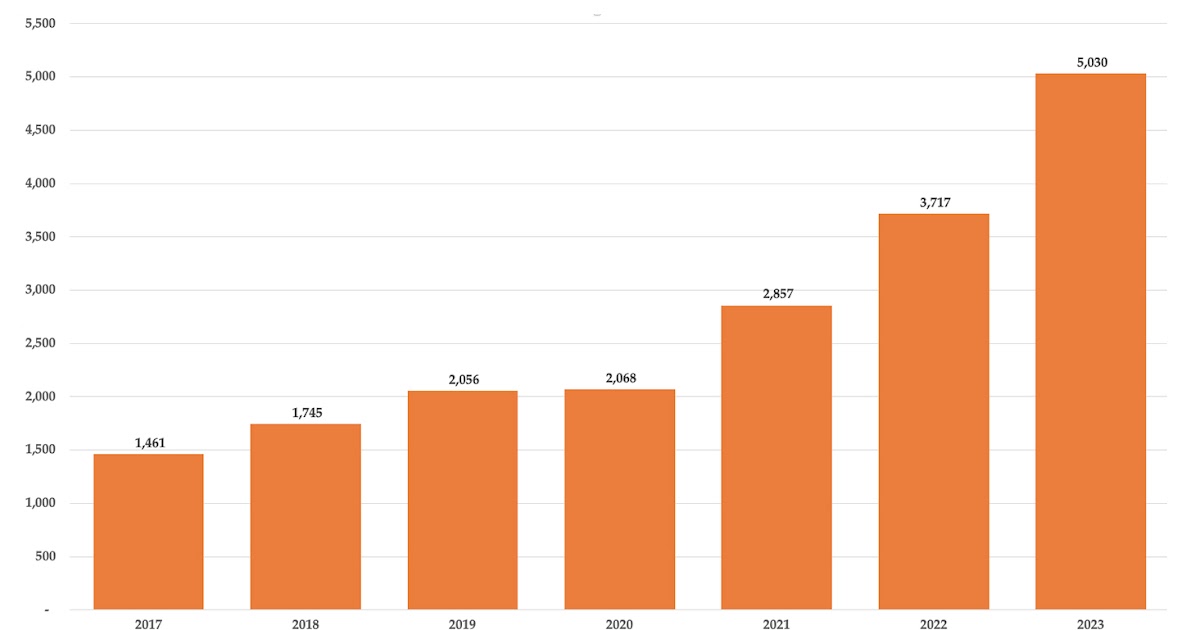

The preliminary year-to-date results are on a record-shattering

pace. As of the week ending Aug. 25,

2023 there have been 5,030 new Blu-ray releases … last year at this time there

were 3,717 Blu-rays released (2022 finished with 6,028, an all-time record).

When you make business decisions based on faulty

data what do you get?

Well, we will go out on a limb here and say, bad

decisions. Sure, the data might be

faulty, but it is close enough, so full steam ahead … or perhaps better put,

stream ahead.

Let’s sell the paperback editions before the hard

cover copies, because no one cares about physical media. That is exactly what is happening … and all

of this in the middle of two major labor actions.

Management at the various “Hollywood” studios (note,

only Paramount is actually in Hollywood) either don’t care that everything is

burning down, or don’t see that everything is burning down … ego versus, dare

we say it, lack of insight.

From the “Hollywood” studio point of view, physical

media — DVD and Blu-ray — is dying, if not already dead. They instead plunge ahead with the streaming

wars that cost them billions of dollars every year and compound this fiscal insanity

by delivering pristine masters of their film and series programming to “void

fillers” and “helpers” with nary a thought as to the consequences. Paperback editions before hard cover, that’s

the religion.

A reality check is in order. As of

the week ending Aug. 25, 2023, we have consumed 34 of the street-date Tuesdays

of the year. That leaves 18 more product

cycles left in 2023. Keep that in mind.

Thus far the “Hollywood” studios, the very same “Hollywood”

studios that are losing $600 million a month on streaming, have churned out 242

new Blu-ray product offerings.

The boutique labels — independent labels — do the

heavy lifting with 1,085 new Blu-ray product offerings. If you are good at math, that adds up to

1,327 Blu-ray SKUs during the first 34 weeks of the year. That is an average of 39 new Blu-ray product

offerings each week.

The entire industry’s business analytics are based

on what they see. 39 Blu-ray titles a

week … Blu-ray is either dead, or dying, based on those numbers.

39 Blu-ray titles a

week

Blu-ray is either dead, or dying,

based on those numbers.

It’s called GIGO.

Garbage In, Garbage Out. If you

believe 120 million households are served by 39 new Blu-ray titles per week,

then you are quite content to lose billions of dollars each year on streaming

and sell paperback editions of your film and television assets before cashing

in on the hard cover editions.

Here is where data is not so precise. These 1,327 new Blu-ray titles — the action

that business decisions are being made on — account for just 26.4 percent of

the releases through the first 34 weeks of 2023 (4.8 percent for the studios

and 21.6 percent for the boutique shops).

The rest?

The 73.6 percent that remains, where is that coming from?

Two sources account for the bulk of the Blu-ray

titles being delivered to consumers.

One is legitimate and one not so much.

One source operates below the radar in local markets and the other

source is quite visible, but ignored, willfully ignored.

First the legitimate source … this would be local

broadband or public access suppliers who use the Blu-ray, not for its hi-def

appeal, but for its capacity. You can

get more stuff on a Blu-ray disc than you can on a DVD … that’s the long and

the short of it.

Micro broadcasters have churned out 608 new Blu-rays

thus far this year, or 12.1 percent of the release pie. Sure, the dollar volume is also micro, but

when you are a local public access system, every dollar counts.

They sell copies of the local sporting events, graduations,

concerts in the park, public meetings (some by law) and other programs that the

public might have an interest in.

Two points should be noted before dismissing this source

as just peanuts.

First, they sell Blu-ray titles week in and week out

… they wouldn’t be doing it as a hobby, so consumers are buying from this

below-the-radar source. Not much in the

way of dollar volume, we concede that, but every little bit helps when you are

operating the equivalent of a roadside fruit stand.

Second, they are making use of the Blu-ray format

for capacity. Manufacturing it on

demand … an order arrives, they burn a disc from their video files and out the

door it goes. It is not that

complicated.

If they can do this, then why can’t the streaming

giants with their programming?

All three of these sources, studios, boutiques and

micro broadcasters are legitimate. They

are selling copies of what they produce and own. They account, so far this year, for 38.5

percent of all Blu-ray titles released.

What remains, the part of the ice berg below the

water — 61.5 percent of the mass — are Blu-rays from “helper” and “void-filler”

sites. Last century we called these

sources pirates or bootleggers.

Not included in the year-to-date numbers are those “honey

pot” sources operating out of China, Sri-Lanka and other exotic places where

you have to be out of your mind to serve up credit card information to get a

$12.99 Blu-ray edition of your favorite movie or television show.

Nope, we’re just tracking those in Tampa, Las Vegas,

Oklahoma City, across the border in Canada, some European sources that have

been operating forever and the like.

This is where the paperback before hard cover

analogy comes in handy to understand why 61.5 percent of all Blu-ray titles

released thus far this year are from “helper” sources.

When a film first surfaces at your local multiplex,

the distributor (studio or independent) shares in the revenue generated with

the local exhibitor. That’s the hard

cover first edition.

When the same rights owner manufactures and sells

physical media (DVD, Blu-ray and 4K Ultra HD), the revenue generated, either

through retail distribution or direct-to-consumer sales, is exclusive. It is a one-off transaction with one consumer

at a time — the rights owner controls it.

This too is a hard cover edition.

Everything else that follows is the paperback version. The bulk of consumers who either don’t go

out to the movies (couch potatoes) or don’t buy physical media are the

down-market audience. They might watch

a version of a movie with a ton of commercials … they don’t care. They might watch it on Netflix, or Amazon

Prime or the Peacock; Disney+ and on and on.

They consume it and move on.

The first two transactions — theatrical and physical

media — the rights owner controls. But,

when you slip the paperback version into the revenue stream before the hard

cover sales have been tapped out, you invite “helpers” to share in the action.

The moment a film or series streams, a pristine

master of the program is out there and if you haven’t satisfied consumer

demand, someone else will. Just look at

the numbers — and we are just talking Blu-ray — and you can’t help but notice

that 61.5 percent of the Blu-ray releases so far this year are stolen

intellectual properties.

Week after week major motion pictures have a digital

sales window (paperback version) before the hardcover edition is made available

… “helpers” are literally served up a master of the film to fill consumer

demand and that’s exactly what they do.

This past week alone, we had “helper” Blu-ray

editions of director Sammi Cohen’s You are So

Not Invited to My Bat Mitzvah, starring Adam Sandler, filmmaker

Carlos Alonso Ojea’s Killer

Book Club, director Anthony Stacchi’s

animated adventure, The Monkey King, plus

Meg 2: The Trench, Past Lives and Evil Dead

Rise.

That’s just the new film releases. Series programming would take up even more

space, but to keep it simple, if it is streamed, it is available on Blu-ray (or

DVD) … on average 91 new “helper” Blu-rays arrived every week this year. That’s what you get when you sell the

paperback edition before fulfilling consumer demand in the channels you control

… and do nothing about it.

Next week it will be a new horror story, you can

count on it!